carried interest tax uk

The carried interest rules impose a minimum 28 per cent tax on carried interest distributions to UK resident fund managers subject to potential reduction for those who are non-domiciliaries. Under the IBCI Rules carried interest which is income-based carried interest will be taxed.

Match Of The Day Pundits Accused Of Avoiding 4 5 Million In Tax Descrier News Match Of The Day Tax Match

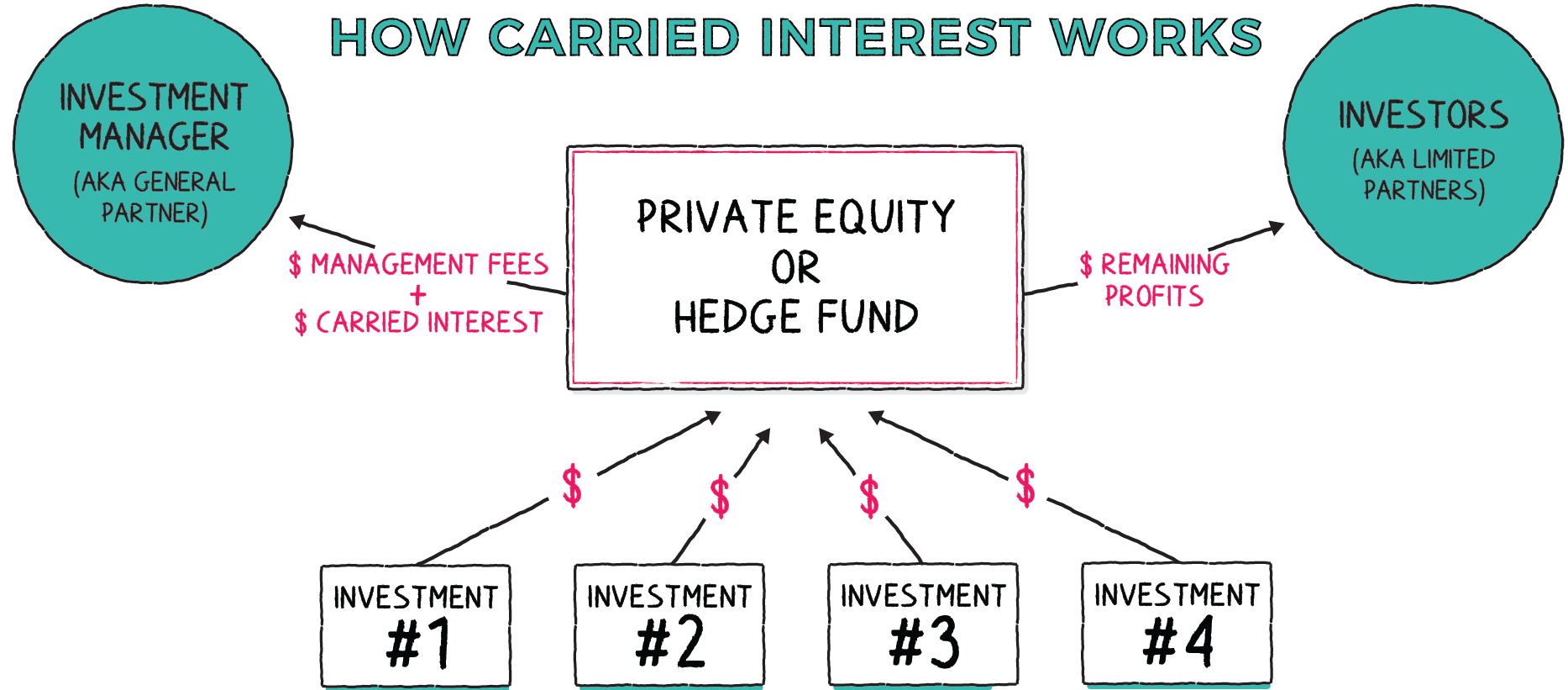

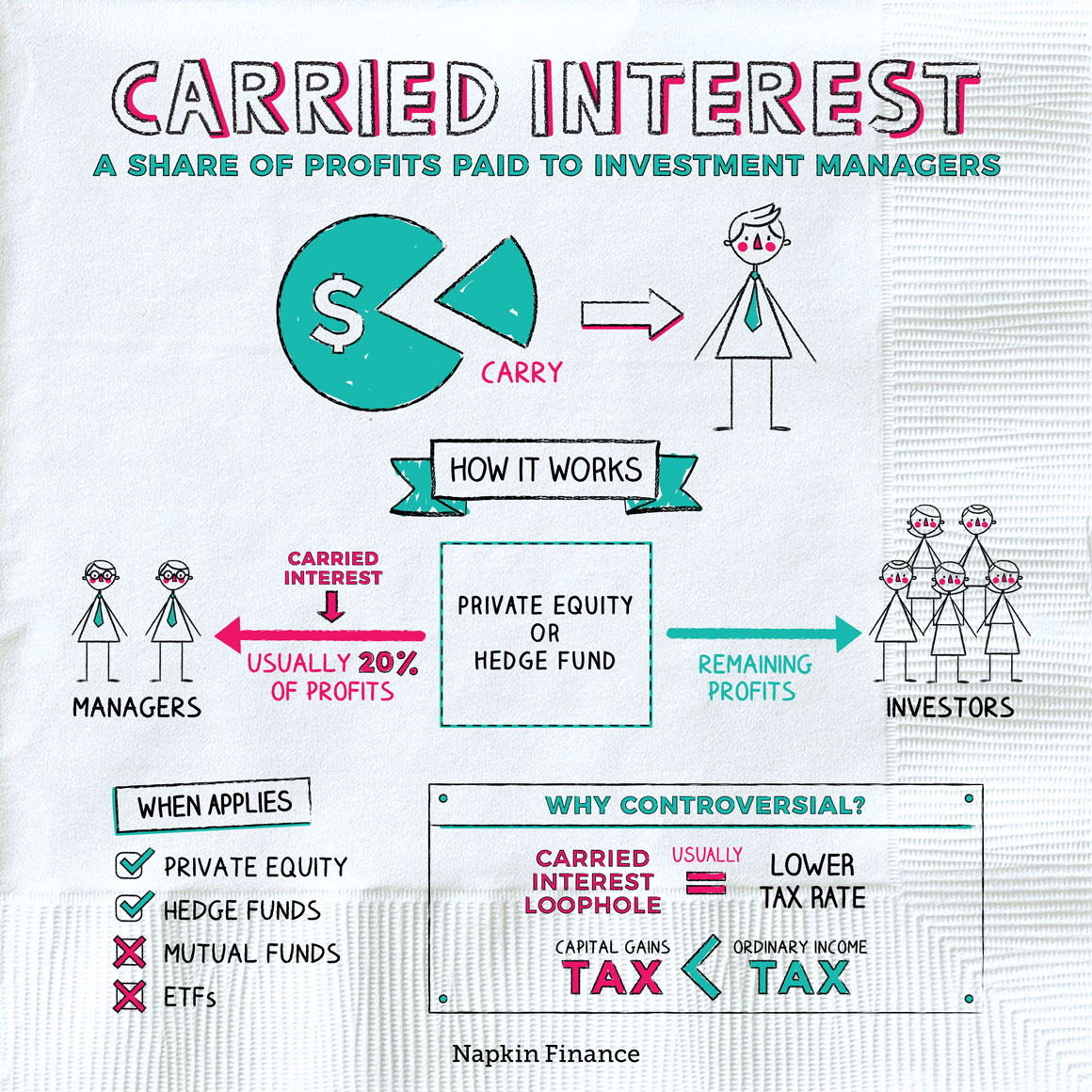

Carried interest income flowing to the general partner of a private investment fund often is treated as capital gains for the purposes of taxation.

. HMRC Enquiries into the Tax Treatment of Carried Interest. Carried interest is wholly IBCI if the relevant fund holds its assets for an average of 3 years or less. Those rules apply to carried interest arising on or after 8 July 2015 but also contained transitional rules.

Income Based Carried Interest IBCI which is subject to income tax and NIC and carried interest which is not IBCI which is subject to capital gains tax CGT. We are aware of an increase in the number of enquiries into the tax treatment of carried interests HMRC are raising at a House level as well as at an individual level. Tax rate on the carried interest just 28.

Under the current rules carried interestan individual fund managers enhanced share of profits realized from investmentsis taxed as capital gains at 28 while income is taxed at a rate of at least. 8 Capital gains tax analysis. We responded to the review and produced a summary document on carried interest which includes international comparisons.

Under the current system any carried interest earned by a private equity firm from an asset held more than 40 months is taxed as capital gains. Carried interest as a notional payment. Availability of business asset disposal relief and investors relief.

Capital Gains Tax civil partners and spouses Self Assessment helpsheet HS281 Collection. Printable version Send by email PDF version. We also published a comment piece following the OTS interim report and the New Horizons Report showcasing how the industry contributes to the UK economy and.

Carried interest on investments held longer than three years is subject to a long-term capital gains tax with a top rate of 20 compared with the 37 top rate on ordinary income. Over 2015 and 2016 new rules relevant to carried interest were introduced that were designed both to reduce the scope for avoidance and to restrict the beneficial tax treatment. First the Section 83b Election allows the taxpayer to take the carried interest into income in the tax year it is granted rather than in a later tax year when it is sold.

In July 2020 the Office of Tax Simplification published a review of capital gains tax. Carried interest now falls into one of two categories. These enquiries are typically aimed at several investment management.

Carried interest has increasingly come within HM Revenue Customs focus due to the potential risk of ordinary management fees being disguised as carried interest to avoid income tax. Since the value of a carried interest in the tax year it is granted is likely zero the election produces a benefit because the taxable income from the carried interest will be zero. Private equity executives receiving carried interest could be in for a significant tax hike after the UK announced an investigation into the countrys capital gains tax system.

Some view this tax preference as an unfair market-distorting loophole. 9 Reporting obligations in relation to carried interest. Capital gains tax treatment of carried interest.

Tax increase on carried-interest income could potentially hurt small businesses and big investors such as endowments foundations and pension funds. Others argue that it is consistent with the tax treatment of other entrepreneurial income. Carried interest refers to a longstanding Wall Street tax break that let many private equity and hedge fund financiers pay.

Historically carried interest returns have been taxed as capital gains arising on the disposal of a funds underlying investment a treatment preserved by the DIMF rules. The Tax Cuts and Jobs Act enacted at the end of 2017 added Section 1061 which generally increases the holding period for an individual to qualify for favourable long-term capital gain related to certain partnership interests such as carried interests held by fund managers from one year to three years. The new carry rules have effect in relation to carried interest arising on or after 8 July.

PAYE and NICs indemnity. New clauses are inserted by Finance Act 2016 which aim to beef up the tax charged and ensure that investment fund managers will pay at least 28 per cent tax on the economic value of the carried interest they receive. However the rate of CGT applicable to carried interest remains at 28 whereas a rate of 20 applies to most other types of capital gain.

Our previous blog article on the new rules for the taxation of carried interest looked at their general impact on investment managers including the introduction of the concept of income-based carried interest IBCI and the rule that carried interest that is not IBCI is to be treated as giving rise to UK situs capital gains irrespective of the situs of the underlying. The UK Government as anticipated issued draft legislation on 9 December designed to establish clear rules as to when carried interest can qualify for favourable capital gains tax treatment. Additionally in April 2016 the UK government introduced legislation the income-based carried interest rules to restrict the capital gains tax.

And that planning. 10 Capital gains tax analysis before 8 July 2015. This measure will make the tax system fairer by ensuring that individuals to whom a gain arises in the form of carried interest are taxed on their true economic gain.

Arms length investments made by the fund manager will not be. This can be as much as 20 at a higher rate or 28 on real estate assets. NEW YORK Reuters -Private equity and hedge funds cautioned on Thursday that a proposed US.

Withholding employee Class 1 NICs.

How Does Carried Interest Work Napkin Finance

220v 110v Nail Fan Acrylic Uv Gel Dryer Machine In 2022 Gel Uv Gel Dryer Machine

Learn The Tips For Reducing Inheritance Tax Liabilities At Http Www Harleystreetaccountants Co Uk Top Five Tips For Reducing Inheritance Tax Liabilities

Dezeen Book Of Interviews Now With Free Uk Shipping Book Design Dezeen Design

How Does Carried Interest Work Napkin Finance

Carried Interest Plans Can Benefit Both The Fund Management Industry And Investors Intertrust Group

Einstein Tuition Private Home Tuition Singapore Private Tutors Tutor Paying Taxes

Pwc Cn Publication New Year Good News Carried Interest Tax Concession

Capital Gains Tax Examples Low Incomes Tax Reform Group

Pin On Money Saving Frugal Debt Free Budgeting

Tax And National Insurance Contribution Rates Low Incomes Tax Reform Group

Carried Interest In Private Equity Calculations Top Examples Accounting

Carried Interest In Venture Capital Angellist Venture

Taking Goods Temporarily Out Of The Uk How To Apply Understanding United Kingdom

Carried Interest Is Pure Fiscal Cakeism Financial Times

Taxes On Money Transferred From Overseas In The Uk Dns Accountants Money Transfer Paying Taxes Blog Taxes

Fact Sheet Close The Carried Interest Loophole That Is A Tax Dodge For Super Rich Private Equity Executives Americans For Financial Reform

In 2011 Convey Sponsored A Tax And Regulatory Survey Carried Out By The Institute Of Financial Operations During A Time Of U Tax Infographic Accounts Payable